IRAs Play an Increasingly Important Role in Saving for Retirement

Washington, DC; March 27, 2025—ICI’s latest research shows individual retirement accounts (IRAs), powerful tools for long-term savings, are a significant component of US households’ retirement planning. In mid-2024, 44 percent of US households reported that they owned IRAs, up from 34 percent a decade ago. The study, The Role of IRAs in US Households’ Saving for Retirement, 2024, gathers information on the characteristics and activities of IRA-owning households in the United States.

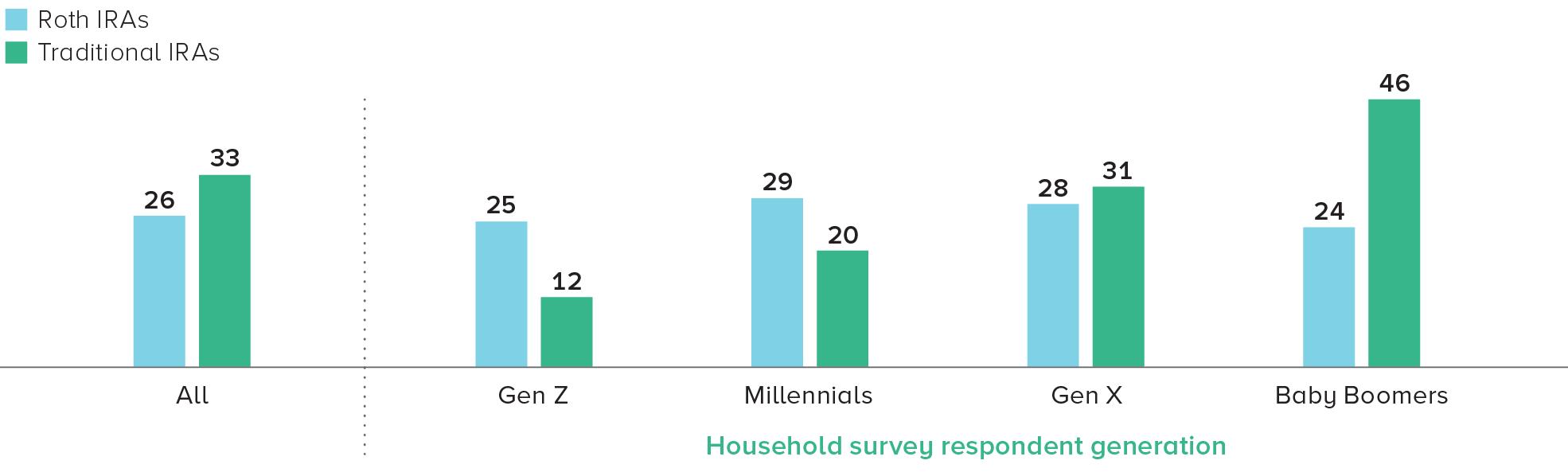

Traditional IRAs were the most common type of IRA, owned by 33 percent of US households in mid-2024, followed by Roth IRAs (owned by 26 percent of US households) and employer-sponsored IRAs (4 percent). Nearly 9-in-10 IRA-owning households also had employer-sponsored retirement plan accumulations or defined benefit plan coverage.

“IRAs, often in tandem with retirement plans at work, are helping millions of people of all ages secure their financial future. The survey results show that a majority of Americans, nearly three-quarters of US households, have tax-advantaged retirement savings through work or IRAs,” said Sarah Holden, ICI Senior Director of Retirement and Investor Research. “Both traditional and Roth IRAs have become increasingly popular over time, with younger households focusing on Roth IRAs and older households more likely to own traditional IRAs.”

Younger Households More Likely to Own Roth IRAs; Older Households Have Rising Focus on Traditional IRAs

IRA ownership; percentage of US households within each generation group, 2024

Source: Investment Company Institute Annual Mutual Fund Shareholder Tracking Survey

Rollovers from employer-sponsored retirement plans have fueled growth in IRAs. In mid-2024, 59 percent of traditional IRA–owning households indicated that their traditional IRAs contained rollovers from employer-sponsored retirement plans. Among households with rollovers in their traditional IRAs, 85 percent recognized the importance of preserving their work nest egg, indicating that they had rolled over the entire retirement account balance in their most recent rollover. Further building their savings, 41 percent of traditional IRA–owning households with rollovers had also made contributions to their traditional IRAs at some point.

As policymakers contemplate the role of employer plans and IRAs in completing Americans’ financial pictures, it’s important to recognize the life-cycle of retirement saving. The fact that 84 percent of near-retiree households have retirement plans or IRAs highlights the strong position they are in as they approach retirement.

Other findings include:

- Most IRA–owning households have a planned retirement strategy. In mid-2024, 69 percent of traditional IRA–owning households and 65 percent of Roth IRA–owning households indicated that they have a strategy for managing income and assets in retirement. Typically, these strategies have many components, including: reviewing asset allocations, determining their retirement expenses, developing a retirement income plan, setting aside emergency funds, and determining when to take Social Security benefits.

- Traditional IRA–owning households with rollovers cite multiple reasons for rolling over their retirement plan assets into traditional IRAs. The three most common primary reasons for rolling over were not wanting to leave assets behind at the former employer, wanting to consolidate assets, and wanting more investment options (23 percent, 19 percent, and 14 percent of traditional IRA–owning households with rollovers, respectively).

- Recent years show a slight upward trend in contribution activity, although fewer than one in five US households make contributions to IRAs. Across all US households, 16 percent contributed to traditional or Roth IRAs in tax year 2023. Looking at households owning traditional or Roth IRAs in mid-2024, 37 percent made contributions in tax year 2023.

- IRA withdrawals were infrequent and mostly retirement related. Thirty-one percent of traditional IRA–owning households in mid-2024 took withdrawals in tax year 2023, in line with recent prior years.

- Majority of traditional IRA withdrawals were made by retirees. Ninety percent of households that made traditional IRA withdrawals were retired. Only 5 percent of traditional IRA–owning households in mid-2024 headed by individuals younger than 59 took withdrawals.

About the Study

“The Role of IRAs in US Households’ Saving for Retirement, 2024” reports information from two separate ICI household surveys. ICI’s IRA Owners Survey, which was conducted from May to June 2024, is based on a representative sample of 3,222 US households owning traditional IRAs or Roth IRAs. The IRA Owners Survey was conducted on the KnowledgePanel®, a probability based online panel designed to be representative of the US population. The KnowledgePanel® is designed and administered by Ipsos. ICI’s Annual Mutual Fund Shareholder Tracking Survey, which was conducted from May to June 2024, is based on a sample of 9,011 US households also drawn from the KnowledgePanel®.

For more information about the role of IRAs in US households’ saving for retirement, see the appendix to the paper, available at www.ici.org/files/2025/per31-02.pdf.