Cross-Trading Reform: Unlocking Savings and Efficiency for Funds and Investors

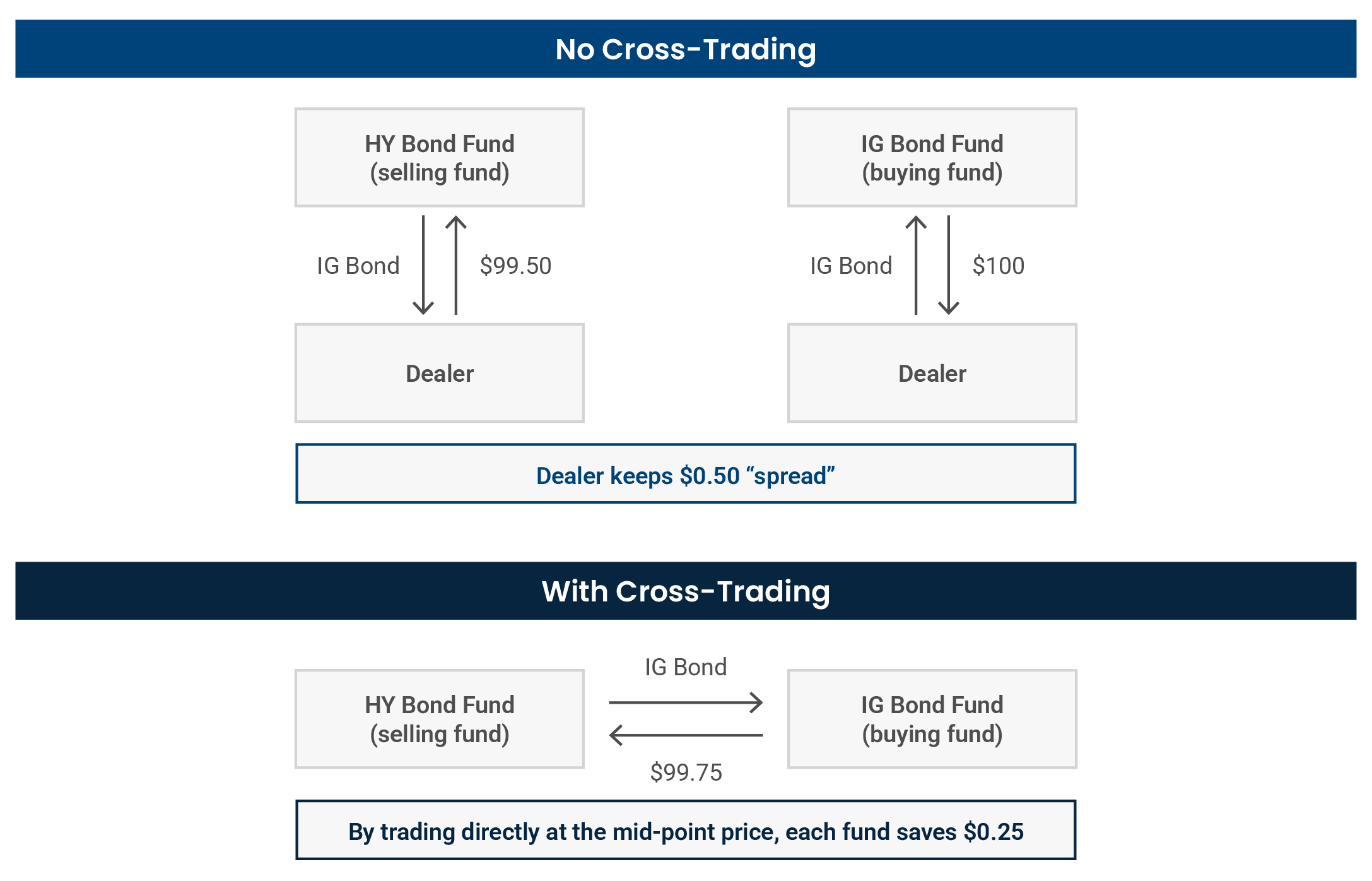

Cross-trading involves affiliated funds trading directly with one another, avoiding dealers and transaction costs, saving investors money. For decades, the SEC permitted this practice within carefully designed guardrails, enabling funds to operate more efficiently while protecting investors.

That framework was disrupted in 2020, when the SEC sharply curtailed fixed-income cross-trading through an unrelated rulemaking. The result has been higher costs for investors and the reversal of a regulatory approach that had worked well for decades.

The SEC recently signaled an openness to reform, presenting an opportunity to once again unlock hundreds of millions of dollars in potential savings for investors.

Why Cross-Trading Benefits Investors

Cross-trading enables more efficient portfolio management by allowing advisers to trade securities between funds when mutually beneficial.

For example, a high-yield bond fund may hold a bond whose credit rating gets upgraded to investment grade. The fund’s adviser may still like the bond, but the fund’s investment policy may limit its ability to continue to hold it in that fund. This same adviser also may manage an investment grade bond fund looking to add to its portfolio. Cross-trading allows the investment grade bond fund to secure a high-quality investment and both funds to save money.

This is not a novel concept. The SEC has long recognized the value of these transactions.

Although Section 17(a) of the Investment Company Act generally prohibits affiliated funds from trading with one another, the Commission adopted Rule 17a-7 to permit cross-trading subject to important safeguards, including fair pricing, board oversight, and recordkeeping. Over time, the SEC updated Rule 17a-7 and provided staff guidance to reflect market developments, expanding the universe of eligible securities and allowing the use of third-party pricing services for municipal bonds.

The potential savings for investors are substantial: ICI conservatively estimated that in 2020, fixed-income cross-trading saved funds and their investors nearly $330 million.

Problem: A 2020 Regulatory Change

Unfortunately, cross-trades of fixed-income investments have been largely prohibited due to guidance that the SEC adopted alongside the unrelated 2020 fair value rule. To be eligible for cross-trading, a security must have a “readily available market quotation.” But the SEC narrowly redefined that term for purposes of both the cross-trading and fair value rules, severely limiting fixed-income cross-trading.

Although the SEC indicated that it would consider revisions to Rule 17a-7 to address the consequences of that redefinition, the following year—under a different Chairman—the SEC dropped this important project from its agenda. While concerns about conflicts of interest, such as one fund “dumping” unwanted securities into another or unfair pricing, deserve fair consideration, they can be effectively mitigated.

Solution: Multi-Faceted Principles-Based Reform

The SEC can restore the benefits of cross-trading while maintaining strong investor protections by focusing on five key elements:

1. Modern scoping mechanism

Cross-trading should not be limited to exchange-traded equities. Funds should be permitted to cross-trade securities that have Level 1 or 2 inputs under U.S. Generally Accepted Accounting Principles. This would allow cross-trading in commonly held fund investments with secondary market trading, such as corporate and high-yield bonds.

In our survey, we found that almost all (99.6%, in dollars) of the fixed-income securities that funds cross-traded in 2020 were classified as Level 2 securities. This change would better align Rule 17a-7 with modern fixed-income markets, where valuation inputs are standard, widely observable, and used throughout the asset management ecosystem, including for daily valuation of fund shares.

2. Updated pricing provision

Funds should be allowed to price trades using a third-party pricing service and/or dealer quotes, provided they have a reasonable belief that the prices are reliable. This would directly address any pricing concerns because funds would be using an independent third party. Funds could harness their rigorous valuation-related processes and processes related to best execution to help ensure that cross-trades are fairly priced.

3. Risk-based policies and procedures

The SEC should require funds and advisers to adopt policies and procedures that take a risk-based approach to evaluating, pricing, and approving potential cross-trades. This would align with the SEC’s expectations in other areas, such as the fair value rule, that recognize that low-risk activity merits less exacting scrutiny.

4. Appropriate board oversight

The fund board’s role should be re-oriented towards effective oversight and recognize the importance of the complementary fund compliance function. Funds should provide boards with reports on at least an annual basis with summary information about cross-trading activity, and the SEC should codify a long-standing no-action letter to allow the board to rely on the fund CCO’s representations that cross-trades during a given period complied with board-adopted procedures.

5. Targeted reporting

While the SEC may want to collect information on cross-trading, it should do so in a way that is not overly burdensome. A balance could be achieved by requiring funds to report aggregated cross-trading information by asset type on Form N-PORT.

Moving Forward

For more than three years, the SEC’s regulatory shift has disrupted an effective cross-trading framework for fixed-income securities, raising costs for investors. However, this disruption presents an opportunity.

As ICI explained to SEC Chairman Paul Atkins, the SEC can modernize Rule 17a-7, preserve strong safeguards, and deliver savings to investors. ICI stands ready to work closely with the SEC to achieve those goals.