UCITS Ongoing Charges Decline Across EU

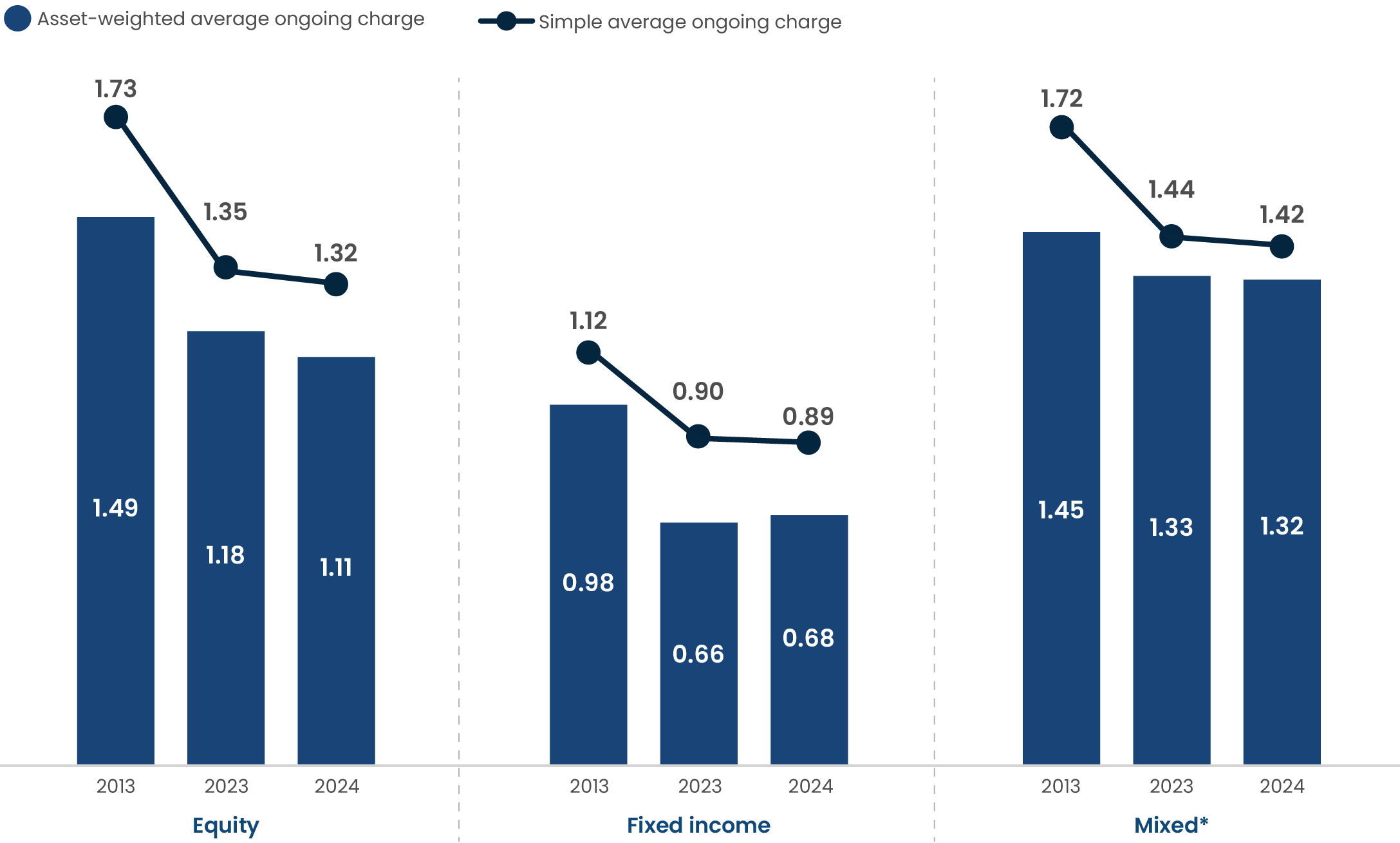

Brussels, Belgium; 18 December, 2025—A new report from the Investment Company Institute (ICI), Ongoing Charges for UCITS in the European Union, 2024, finds that average ongoing charges for equity UCITS declined from 1.18 percent to 1.11 percent over the past year, continuing the trend of significant declines in UCITS charges since 2013.

“UCITS continue to provide investors with the benefits of investing in global markets and access to diverse investment strategies,” commented Shelly Antoniewicz, ICI’s Chief Economist. “At the same time, ongoing improvements in fund structures and pricing make these opportunities more accessible and cost-effective than ever before.”

Average Ongoing Charges for UCITS Have Declined Substantially Since 2013

Percent

*Mixed funds invest in a combination of equity and fixed-income securities.

Note: Data exclude UCITS ETFs.

Source: Investment Company Institute calculations of Morningstar Direct data

ICI’s findings reflect greater economies of scale, a shift of assets toward lower-cost UCITS, the entry of lower-cost funds into the market, and the exit of higher-cost funds. The average total net assets of equity UCITS increased from €403 million in 2023 to €474 million in 2024, allowing funds to benefit further from economies of scale.

New equity UCITS launched in 2024 had a notably lower average ongoing charge (0.76 percent) compared to those exiting the market (1.01 percent). Additionally, competition from lower-cost index trackers has continued to exert downward pressure on the ongoing charges for equity funds.

The average ongoing charge for fixed-income UCITS saw a slight rise from 0.66 percent in 2023 to 0.68 percent. Inflows into higher-cost fixed-income UCITS such as fixed-term bond funds, subordinated bond funds, and high-yield bond funds, among other factors, contributed to this increase. High-yield bonds performed strongly in 2024, delivering total returns in excess of 7 percent and attracting significant investor inflows. Meanwhile, investors continued to allocate capital to fixed-term bond funds, which are characterized by comparatively lower downside risk. These categories collectively received €59 billion in net flows, accounting for about one-fourth of net inflows into fixed-income UCITS.

Key findings:

Average ongoing charges for equity and fixed-income UCITS have declined significantly since 2013. In 2024, the average ongoing charges for equity and fixed-income UCITS were down 26 percent and 31 percent, respectively, from 2013.

Average ongoing charges for equity and fixed-income UCITS ETFs have decreased substantially since 2013. In 2024, the average ongoing charges for equity and fixed-income UCITS ETFs were down 46 percent and 28 percent, respectively, from 2013.

Cross-border UCITS provide European investors with a much larger range of investment options, but such funds often incur additional marketing or registration costs. In 2024, the average ongoing charge for cross-border equity funds was 1.30 percent, compared with 1.21 percent for single country equity funds.

Note: UCITS investors pay ongoing charges from their fund investments for a host of services, including portfolio management, administration, compliance, distribution, accounting services, and legal costs.

Click here to read the full report.